Opportunity:

Solution:

Outcome:

Building a bank’s digital presence can be a daunting task due to the complexity and scale of the project. Even with an already successful in-person approach to banking, this regional bank faced the challenge of translating its tailored offline experience to match the way it operates online.

Opportunity:

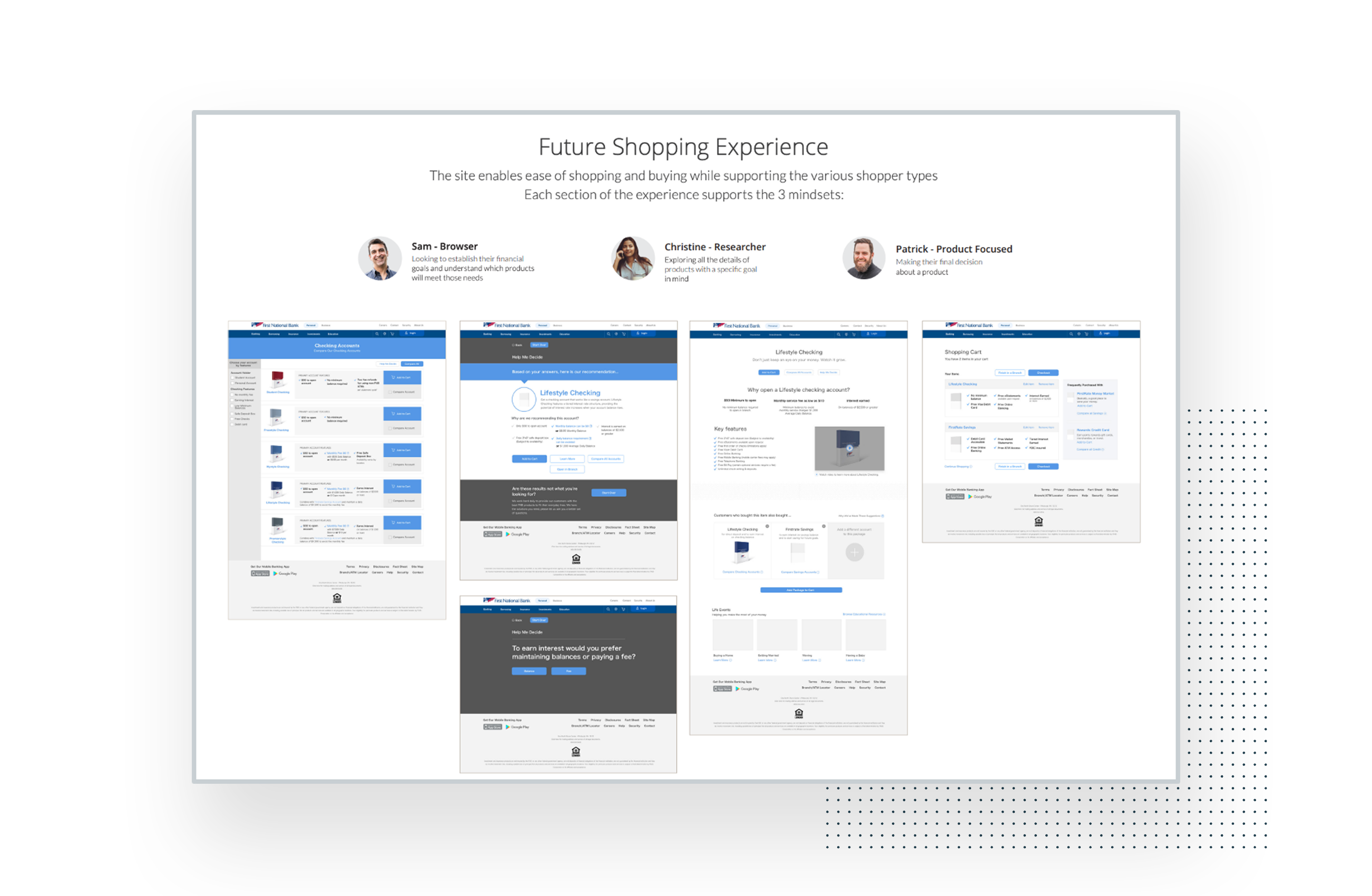

When customers have financial questions, do they go online or pick up the phone? While a personal touch is valued by many customers, it can present challenges for banks looking toward the future of banking that want to also focus on streamlining their operations to offer more efficient digital services to their customers.

Recognizing a need to modernize its digital branch, this growing regional banking player looked to G2O to deliver a streamlined, shoppable website that mirrors offline decision-making. The goal: Offer customers and prospects alike the opportunity to benefit from reaching their financial goals digitally.

Before this goal could be met, however, G2O and the regional banking institution would need to develop a plan that would answer the question: How do we redesign our website to integrate with our in-branch experience?

While the regional bank was known for its exceptional services at its brick-and-mortar locations, it realized that its digital presence lagged behind offline experiences in quality. In order to maximize its digital customer experience, G2O would need to align multiple websites into a streamlined, shoppable hub.

Solution:

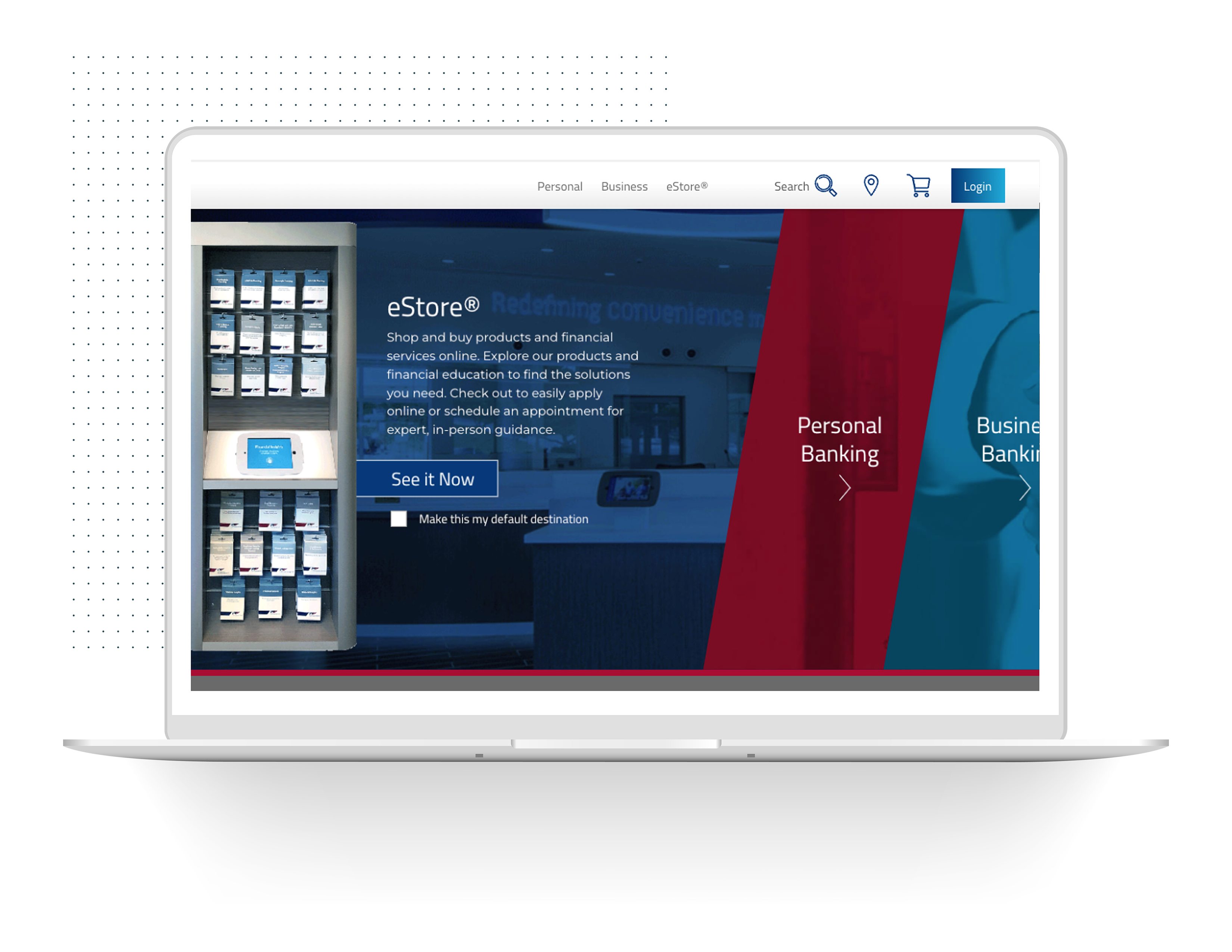

The client collaborated with G2O as an extension of its internal team with the goal of enhancing the bank’s eCommerce capabilities. This comprehensive strategy included incorporating shopping cart functionality, receiving support for IT and marketing functions, and utilizing UX expertise.

Offline, the bank had begun updating its branches to reflect an Apple store-like experience, which included utilizing scannable products and educational tablets. Combining eCommerce and financial mindsets, G2O sought to bring this experience to life online by visualizing the type of discussion customers might have with their bankers in person – and transforming those experiences to a digital format.

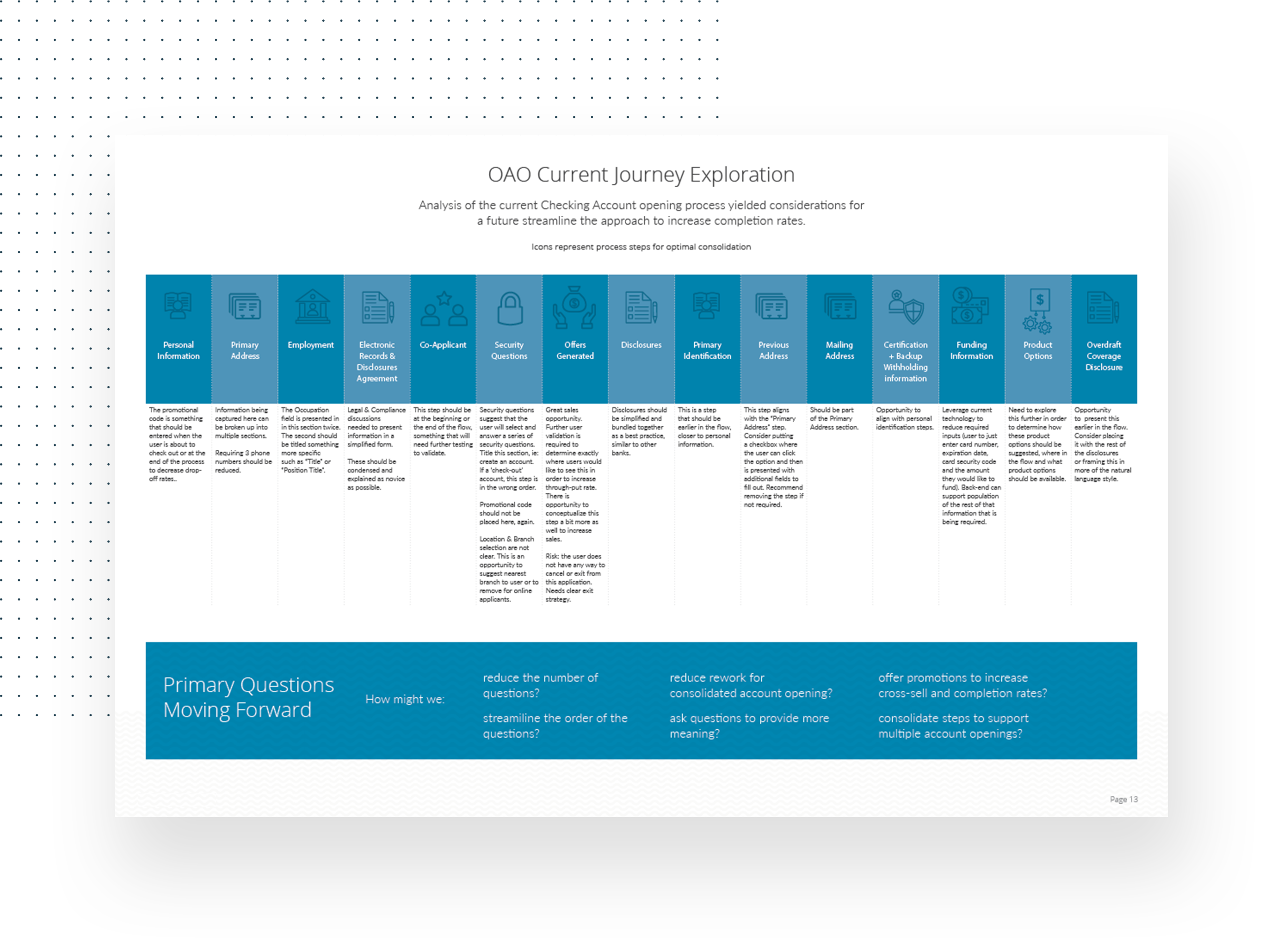

Combining our expertise in eCommerce and finance, G2O developed a three-part plan to improve the bank’s digital capabilities: Identification, Prototyping & Validation, and Manifestation. Each component included a multi-step approach to achieving success.

Identification

Uncovered opportunities to develop offerings such as Goal Advisor, the ability to guide customers pre-login to a subset of products based on their answers to high-level questions, mimicking the in-branch experience of personalized recommendations.

Developed insights into how to better attract and support small business customers based on their distinct needs from the retail bank.

Prototyping & Validation

Honed in on results that revolved around navigating and filtering, as well as confirmed the potential of a Product Wizard for products such as personal checking accounts.

Manifestation

Built the new website from scratch with all functionality, including personalization and retention tactics such as “abandoned cart follow up.”

Designed all necessary templates to empower trained associates to manage future website design updates and future technology requirements.

Outcome:

The G2O team’s extensive range of expertise enabled them to transform this bank’s online digital presence into a successful, award-winning site that offers:

- Approximately 5,000 pages and 27 templates

- Streamlined eCommerce and checkout experience increases average products per customer from 1.0 to 1.6.

- Integration with the client’s CMS to highlight their banking products and services

- Alignment of the new design to third-party systems such as a branch and ATM location finder or appointment scheduler

- Iconography library for the bank’s continued use

- Post launch migration of a once-separated mortgage site into the bank’s main site

As the G2O team continues to move forward with this long client partnership, future goals include improving the customer user experience. Plans include adding the ability for users to check out multiple products, such as both opening a checking account and applying for a mortgage in a single user session.

By defining the technology and expertise necessary to deliver a meaningful shopping cart experience, the G2O team modernized the bank’s site design and empowered the banking institution to successfully manage its future.